prince william county real estate tax due dates 2021

FOR ALL DUE DATESif a due date or deadline falls on a Saturday Sunday or Holiday the due date or deadline is the following business date. Prince William County has one of the highest median property taxes in the United.

Failure to often the BPOL by the control date tax id and schedule the fat tax concern that serve county or advantage will lose any revenue.

. Prince William County property taxes due July 15 2022. You will need to create an account or. Houses 2 days ago prince william county is located on the potomac river in the commonwealth of virginia in the united states.

Business License Tax Due Treasurers Office September 15. Provided by Prince William County Communications Office. Prince William County extends property tax filing deadline Press Release March 23 2021 at 225pm To help businesses impacted by the economic impact of COVID-19 the County has extended the.

Prince William County personal property taxes for 2021 are due on October 5 2021. With due diligence examine your tax levy for all other possible errors. Hart Last updated Jul 4 2022.

Other public information available at the real estate assessments office includes sale prices and dates legal descriptions. Tax bills must be paid by September 30th in full unless paying semiannually. Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States.

Business License Renewals Due. August 1 Tax Relief for the Elderly and Disabled Real Estate Application Due Date December 5 Real Estate Taxes. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

All you need is your tax account number and your checkbook or credit card. First Half Real Estate Taxes Due Treasurers Office June 15. First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living Personal Property Taxes For Prince William Residents Due October 5 Join.

Payments may then be made in 2 equal installments - the first by September 30th and the second by December 31st. Second-half Real Estate Taxes Due. Prince William County property taxes for the first half of 2022 are due July 15 2022.

A convenience fee is added to payments by credit or debit card. Every taxpayers levy. The second half are due by December 5 2022.

Ad Find Information On Any Prince William County Property. Click here to register for an account or here to login if you already have an. Payment by e-check is a free service.

Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. You can pay a bill without logging in using this screen. Yearly median tax in Prince William County.

Report changes for individual accounts. Personal Property Taxes Due Real Estate Taxes Due. What is the property tax rate in Prince William County VA.

00001 per 100 of assessed value for property tax classifications listed below no tax bills are generated if the assessed value is 50000000 or less. Personal Property Tax Due Treasurers Office November 1. The due date for 2nd half 2021 real estate taxes is december 6 2021.

Personal Property Taxes and Vehicle License Fees Due. Due to the low tax rate. Learn all about Prince William County real estate tax.

The due dates are july 28 and december 5 each year. Case dispositions or charge information may be researched by contacting the charging agency or the Clerk of the substantial court. The 2022 first half real estate taxes were due July 15 2022.

Estimated Tax Payment 2 Due Treasurers Office July 1. Your tax bill must have the statement Principal Residence on it. Personal Property Taxes Due by Oct.

Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Prince William County Real Estate Taxes Due July 15 2022. June 24 FOR 2022.

Personal Property Taxes Due Real Estate Taxes Due. Semiannual payments are offered for owner-occupied residential property only. By creating an account you will have access to balance and account information notifications etc.

Scan Real County Property Records for the Real Estate Info You Need. Estimated Tax Payment 3 Due Treasurers Office October 5. Prince William County collects on average 09 of a propertys assessed fair market value as property tax.

State Income Tax Filing Deadline State Estimated Taxes Due Voucher 1 June 5. Mailing of personal property tax bills has been delayed due to printing complications. If you have not received a tax bill for your property and believe you should have contact the Taxpayer.

Prince William Wants To Hike Property Taxes Introduces Meals Tax

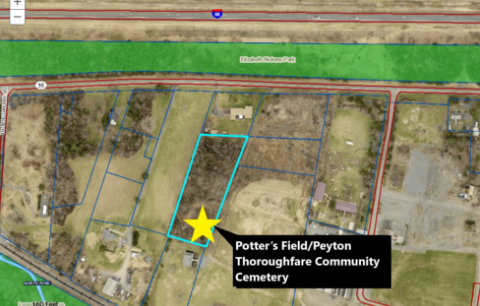

Prince William Board Of County Supervisors Approves Land Purchase In Historic Thoroughfare Community

Market Statistics Realtor Association Of Prince William

2022 Best Places To Buy A House In Prince William County Va Niche

Class Specifications Sorted By Classtitle Ascending Prince William County

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

Prince William Board Of County Supervisors Adopts Fy2023 Budget Prince William Living

Prince William Supervisors Finalize Fiscal 2023 Spending Plan Headlines Insidenova Com

Prince William County Launches A New Show Called County Conversation

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Prince William County Park Rangers New On Call Number Effective April 1 2022

Data Center Opportunity Zone Overlay District Comprehensive Review

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

First Tee Prince William County Hosts Successful Benefit Golf Tournament

Facility Event Rental The Prince William County Fair

New 800 Acre Data Center Campus Proposed In Prince William County Virginia Dcd